Indianapolis Car Accident Lawyer

Helping people is our priority

Since 1993

If you were injured in a car accident on I-465, I-70, Keystone Avenue, or anywhere in Indianapolis, you are likely facing physical pain, mounting medical bills, and stressful calls from insurance companies. You do not have to navigate this alone.

The experienced Indianapolis car accident lawyer team at Christie Farrell Lee & Bell are dedicated to protecting your rights and fighting for the maximum compensation you deserve. With decades of experience and millions recovered for clients across Indiana, we have the knowledge and resources to handle every aspect of your claim, so you can focus on your recovery.

Contact us today for a free, no-obligation consultation. Call 317-593-9202 or fill out our online form.

Why Choose Our Indianapolis Car Accident Attorneys?

When you’re up against an insurance company, you need a law firm with a proven track record. Here’s why accident victims in Indianapolis trust Christie Farrell Lee & Bell:

- Local Indianapolis Expertise: We have a deep understanding of Marion County courts, local traffic patterns, and the tactics used by insurance companies in Indiana.

- Proven Results: We have secured millions of dollars in verdicts and settlements for our clients. Our history of success speaks for itself.

- We Are Trial Lawyers: Insurance companies know we are not afraid to take a case to court. This reputation gives us leverage to negotiate for a full and fair settlement on your behalf.

- No Fee Unless We Win: You pay absolutely nothing upfront. Our firm operates on a contingency fee basis, which means we only get paid if we win your case.

- Award-Winning Representation: Recognized by leading legal organizations for excellence in personal injury law in Indianapolis.

You Don’t Pay Unless Your Case is Won

That’s right, there are no fees for our car accident legal services until we win your case. You only pay us a small portion of the verdict or settlement that we win for you. That’s how we get paid and why we’re on your side when it comes to getting justice and the maximum compensation. You can see some of our featured auto accident case results from previous clients totaling millions of dollars in victory.

Google Reviews From Our Clients

We thoroughly enjoy working with and helping our clients achieve great outcomes from their accident cases and are honored to help them through the legal process.

Speak with a personal injury lawyer today. Call: 317-488-5500

Compensation You Can Recover in an Indianapolis Car Accident Claim

An accident can impact every aspect of your life. Our goal is to secure compensation for all of your losses, both economic and non-economic. An experienced Indianapolis car accident lawyer can help you pursue damages for:

- Medical Expenses: Including emergency room visits, surgery, hospitalization, physical therapy, and future medical care.

- Lost Wages: Compensation for the time you were unable to work while recovering.

- Reduced Earning Capacity: If your injuries prevent you from returning to your previous job or earning the same income.

- Pain and Suffering: For the physical pain and emotional distress caused by the accident and your injuries.

- Permanent Disfigurement and Disability: For scars, loss of limb, or other permanent impairments.

- Wrongful Death: If you lost a loved one, we can help you file a claim to cover funeral expenses, lost financial support, and loss of companionship.

Complete a Free Case Evaluation form now

Types of Car Accident Cases We Handle in Indianapolis

Our attorneys have extensive experience investigating and litigating a wide range of motor vehicle collisions. We understand the unique evidence and legal strategy required for each scenario.

Rear-End & Head-On Collisions

Rear-End accidents and Head-On collisions often resulting in severe whiplash, back injuries, or catastrophic harm, these cases require a thorough investigation into driver distraction, speeding, or impairment.

T-Bone & Intersection Accidents

T-Bone and Side-impact crashes at busy Indianapolis intersections (like 38th & Lafayette) can cause devastating injuries. We work to prove who had the right-of-way and hold negligent drivers accountable for running red lights or failing to yield.

Drunk or Drugged Driving (DUI) Accidents

We aggressively pursue claims against impaired drivers to secure full compensation for victims, including punitive damages where applicable. Read more about our experience with drunk driving accident claims.

Hit-and-Run Accidents

Being left at the scene by the at-fault driver adds insult to injury—but you still have legal options. We pursue compensation through your uninsured motorist policy and thorough investigation in hit-and-run cases.

Accidents in Construction Zones & Due to Road Defects

Construction Zone crashes on I-465 or I-70 aren’t always a driver’s fault. We investigate whether poor signage, road defects, or government negligence contributed to the accident.

Uber & Lyft (Rideshare) Accidents

These claims involve complex insurance rules. We know how to navigate policies for Uber and Lyft to ensure you get the coverage you’re entitled to.

Rollover & Truck Accidents

Rollover and truck accidents often involving commercial vehicles or SUVs, these catastrophic accidents require a rapid and sophisticated investigation into driver logs, vehicle maintenance records, and company negligence.

Distracted Driving Accidents

Distracted drivers – especially those using cell phones – are a leading cause of injury crashes. We’ve helped many victims recover damages in cases involving texting, in-car distractions, and other reckless behavior. Learn more about how we handle distracted driving claims and texting while driving accidents.

Click to contact us today

Understanding Fault in Indiana Car Accidents

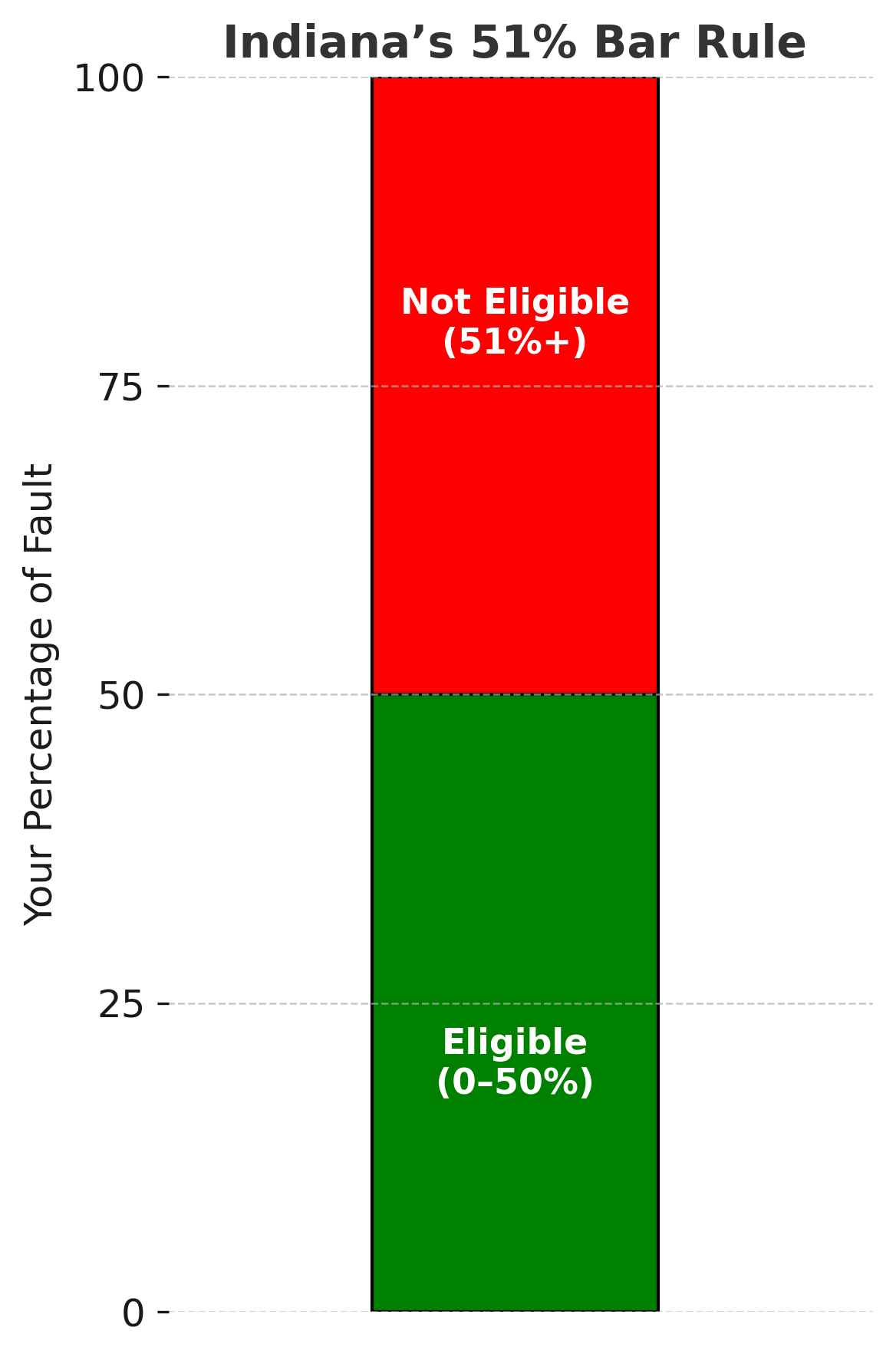

Indiana follows a modified comparative fault system, also known as the 51% Rule. This is critical to your case:

- You can recover damages as long as you are found 50% or less at fault for the accident.

- Your compensation will be reduced by your percentage of fault. For example, if you are awarded $100,000 but found 20% at fault, you would receive $80,000.

- If you are found 51% or more at fault, you are barred from recovering any compensation.

Insurance adjusters often try to shift blame to victims to reduce or deny their claims. An Indianapolis car accident attorney at our firm will build a strong case to prove the other party’s negligence and protect your right to compensation.

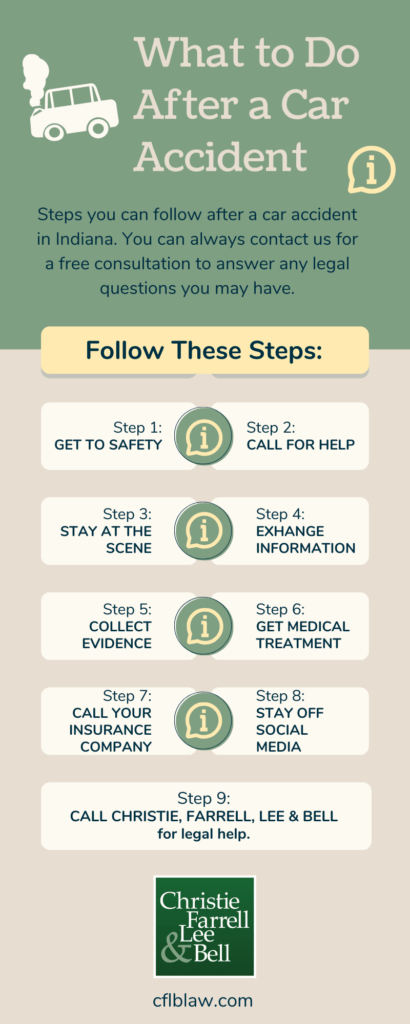

What to Do After a Car Accident in Indianapolis

The steps you take immediately after a crash can significantly impact your health and your legal claim.

Get to Safety: If possible, move your vehicle out of traffic and turn on your hazard lights.

Call 911: Report the accident and request police and medical assistance. An official police report is a crucial piece of evidence.

Document the Scene: Take photos and videos of vehicle damage, skid marks, road conditions, and your injuries.

Exchange Information: Get the names, contact information, and insurance details of all drivers involved. Do not admit fault.

Talk to Witnesses: If there are witnesses, ask for their names and phone numbers.

Seek Medical Attention: Get a medical evaluation right away, even if you feel fine. Some serious injuries, like concussions or internal bleeding, may not have immediate symptoms.

Report the Accident to Your Insurer: Inform your insurance company about the accident but stick to the basic facts. Do not give a recorded statement without speaking to an attorney.

Contact an Indianapolis Car Accident Lawyer: Before you accept any settlement offer, talk to an experienced attorney to understand your rights and the true value of your claim.

You may have many more questions, and that’s okay! These are only meant to be a good place to start before speaking with our auto accident attorney. By choosing an Indiana lawyer with experience and know-how, recovering from a car accident can be a lot less stressful.

Indiana’s Statute of Limitations for Car Accidents

In Indiana, you generally have two years from the date of the accident to file a personal injury lawsuit. If you miss this deadline, you will lose your right to sue for damages.

Important Exception: If your claim is against a government entity (e.g., a city bus or state-owned vehicle), you have a much shorter deadline. You must file a Notice of Tort Claim within 180 days for a city or county entity, or 270 days for a state entity.

It is vital to contact a lawyer as soon as possible to ensure these critical deadlines are met.

Frequently Asked Questions (FAQs)

How much does it cost to hire an Indianapolis car accident lawyer?

Nothing upfront. We work on a contingency fee basis, meaning we only collect a fee if we successfully recover compensation for you.

How much is my car accident claim worth?

The value depends on many factors, including the severity of your injuries, your medical costs, lost income, and the impact on your quality of life. An attorney can evaluate your case to determine its potential value.

Should I talk to the other driver’s insurance company?

It is best to avoid speaking with the at-fault driver’s insurance adjuster. They are trained to get you to say things that can hurt your claim. Direct all communication to your lawyer.

Do I need a lawyer if the accident was minor?

Even seemingly minor accidents can result in long-term injuries. Insurance companies often offer quick, lowball settlements. Consulting a lawyer ensures your rights are protected and you receive fair compensation for all your injuries.

Contact Christie Farrell Lee and Bell Indianapolis Car Accident Lawyer Team Today

Don’t let an insurance company decide your future. The legal team at Christie Farrell Lee & Bell is ready to fight for you and handle the legal burdens so you can focus on healing.

If you were involved in a car accident caused by someone else’s negligence, you may have a legal right to compensation. This applies whether the crash involved a distracted driver, a speeding vehicle, or someone who ignored traffic laws. Serious injuries from vehicle accidents is all we do. Our injury team will let you know if you have a case or not, and how we can help you get results and compensation you deserve. Schedule your free confidential case evaluation with us or call us any time.

Indianapolis Office

951 N Delaware St Indianapolis, IN 46202

Phone: 317-593-9202

Get a FREE Case Review

Schedule Your Free Consultation